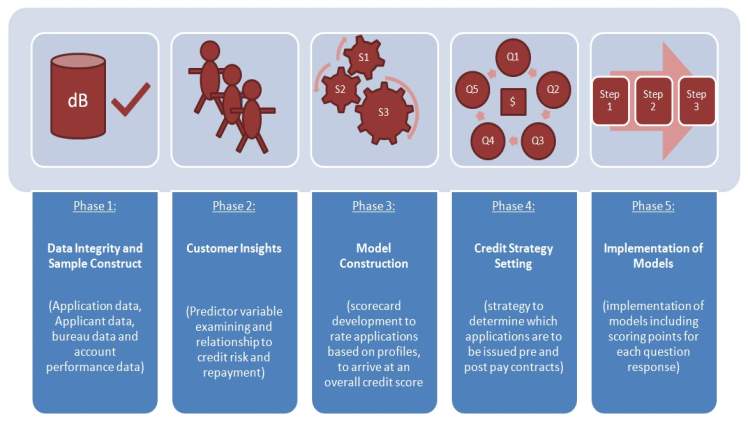

Credit Risk Modelling and Management

Understanding the basics of credit risk modelling and management is important to assessing your risk profile and taking proactive action to protect your business. There are many factors to consider, including bank capital, loan loss reserves, and other aspects of the borrower’s financial situation. This article will discuss these factors and their importance for the lender. It will also outline some of the most commonly used risk mitigation techniques. By the end of this article, you should be able to identify the best strategy for your specific needs.

As a first step, credit risk management focuses on how to calculate the spread between credit risk and the obligor’s equity. It involves identifying the credit risk spread for a portfolio of loans. This spread is the difference between the riskier and safer assets. This spread is calculated using the mean and standard deviation of portfolio losses. It can be calculated using various risk models. Credit risk models are important for banks and regulators to understand the factors affecting bank credit quality.

In addition to assessing credit risk, banks also have to clarify how much they are exposed to counterparty risk. The COVID-19 pandemic has created many challenges for banks and their credit risk models. It is still not clear how COVID-19 will affect the banking industry in the long run. Credit risk modelling and management is one of the most important and complex areas of banking, and this conference will address these key challenges.