Tips for Buying Life Insurance as NRI in India

If you are an NRI (Non-resident Indian) or PIO (Person of Indian Origin), you may wonder if you can purchase life insurance in India, or should you buy life insurance coverage in India? It is natural to have such queries and doubts, and you are not the only one who may have asked yourself these questions. In this write-up, we discussed important things about buying life insurance as an NRI in India.

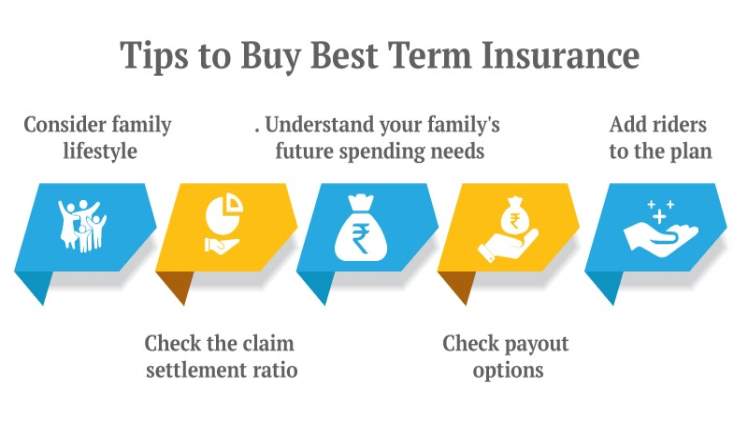

First and foremost, as an NRI in India, as per the Foreign Exchange Management Act, you can purchase any type of life insurance policy, be it an endowment plan, ULIP or a term life insurance policy of your choice. So, if you want to purchase life insurance as an NRI in India, here are a few tips to help you.

Eligibility

As per the insurance companies, an NRI is a person who has lived outside of India for a specific period. As an NRI, you can purchase a life insurance policy in India only if you hold an Indian passport. This is one of the primary eligibility requirements by all insurers. More info about The Basic White Gi

Medical Test

Typically, as an NRI, when you buy a life insurance plan in India, you must undergo a medical examination. The insurers will decide whether they will offer you the coverage and the premium for the policy based on the test results.

You need not be physically present in India to buy life insurance. You can give the medical test in two ways: To know more click Louis Vuitton Handbags

- You can travel to India to get your medical test done. Your insurance company may or may not cover the cost. So, it is pivotal to check with the insurer before you choose the option. In most cases, the insurers do not cover the travel cost, but they do cover the cost of the tests provided you get the test done at specific medical centres suggested by them.

- You can undergo the test in the country of your current residence and send the reports to the insurer.

Premium amount

Suppose you reside in one of the high-risk countries, which is a term used by insurance companies to denote nations that are prone to political instability, you may have to pay a higher premium than those who live in non-risk or safe countries where there is no unrest. This is because of the political situation in the country, your life may be at risk, and the chances are high that you or your family may raise a claim, which increases the insurer’s liability.

Premium payment

Even if you are an NRI living abroad, you may have relatives in India. If so, you can appoint them to manage the policy, and they can make the premium payments in INR. However, if you don’t have any relatives in India, you can pay the premium through FCNR (Foreign Currency Non-Repatriable) Account or NRE (Non-Resident External) and NRO (Non-Resident Ordinary) bank accounts.

Receiving policy benefits upon the demise

As an NRI, when you purchase life insurance in India, you are eligible to receive the policy benefits irrespective of where you are located at the time of demise. The insurer will pay the death benefit to the appointed nominee in Indian currency or the local currency of the country where they reside. While receiving the benefits in foreign currency, the nominee must file specific papers as per the policy’s terms and conditions.

Final Word

Now that you are aware of the different aspects of buying life insurance as an NRI in India, do your due diligence and get the policy of your choice.