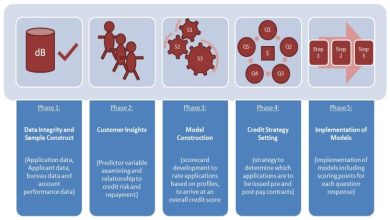

What Determines Your Credit Score?

Many credit-score models account for various components of the score. One factor is the length of time a borrower has been making on their accounts. The longer this period has elapsed, the better the credit score. Keeping all of your accounts open helps your score, and closing any of them can damage it. Another factor is the types of accounts you have. A good mixture of different types of accounts is beneficial to your credit score.

The factors that determine your credit score vary, but the basics are the same. Your score is a reflection of how responsibly you have managed your financial obligations. Your credit score will affect your ability to borrow money, the interest rate you pay on a loan, and your car insurance premium. Having good credit can make it easier to find a job and rent a place to live. However, your credit report may not be the only factor that determines your eligibility for certain types of credit.

The Fair Isaac Corporation, also known by its short name FICO, is the company that first created standardized credit scoring models. Since then, there have been several models created, but the latest ones are very similar to the original. Many lenders now use FICO’s scores. The average FICO(r) score in the U.S. is 710 in 2020. While you can increase your credit score, lenders may still be skeptical. You may need a higher score to obtain credit, but this isn’t a bad thing.